Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Pros

Cons

OnDeck Loan Features

Term Loan

The minimum term loan amount you can get from OnDeck is $5,000 and the maximum amount is $250,000. The APR can change depending on whether or not you pay it off early, but keep in mind APRs typically start on the higher side of online lending.

| Term length | Up to 24 months |

| Repayment period | Daily or weekly |

| APR range | Start at 35% |

| Min - Max amount | $5,000 - $250,000 |

Business Line of Credit

Business lines of credit allow customers to draw on a designated amount of capital when needed, taking as much or as little as they’d like. You can expect higher interest rates and maintenance fees for this type of OnDeck loan. Borrowers who choose this option find value in the flexibility. For example, a line of credit can allow an entrepreneur to deal with cash flow issues quickly as they arise.

| Term length | 12 months |

| Repayment period | Automatic weekly payments |

| APR range | Start at 35.9% |

| Min - Max amount | $6,000 - $100,000 |

OnDeck Interest Rates and Fees

The rates for OnDeck tend to be high, but they are transparent from the start. OnDeck will not charge additional fees later on. In addition, OnDeck has no prepayment penalties, meaning you can pay off your loan early without being subjected to a fee.

| Term Loan | Line of Credit | |

| Origination fees | Between 0% - 5% | Between 0% - 5% |

| Prepayment fees | None | None |

| Late payment fees | Not disclosed | Not disclosed |

| Maintenance fees | 0.4% - 0.42% of the total borrowing amount per month | $20 per month |

| Interest rates | Start at 35% | Start at 35.9% |

How to Qualify for an OnDeck Loan

For both term loans and lines of credit from OnDeck, you do not need perfect credit scores or extremely high annual revenues. We’ve outlined the minimum criteria below, but keep in mind OnDeck will also look at other aspects of your business when making a decision.

| Minimum credit score | 600+ |

| Minimum annual revenue | $100,000 |

| Minimum time in business | 1 year |

Typical OnDeck loan customers have been in business for three years, have an annual business revenue of $300,000+, and a personal credit score of 650.

The OnDeck Loan Application Process

When applying for an OnDeck loan or line of credit, you’ll need the following documents:

- Tax ID number

- Social Security number

- Annual gross revenue (estimated)

- Three months of business bank statements

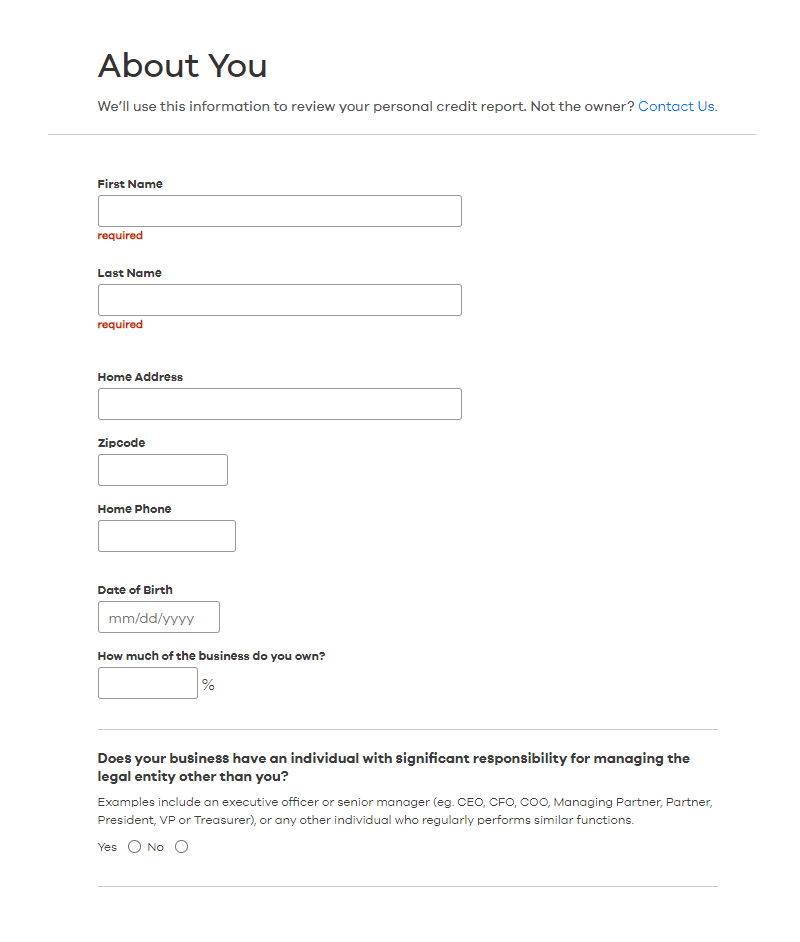

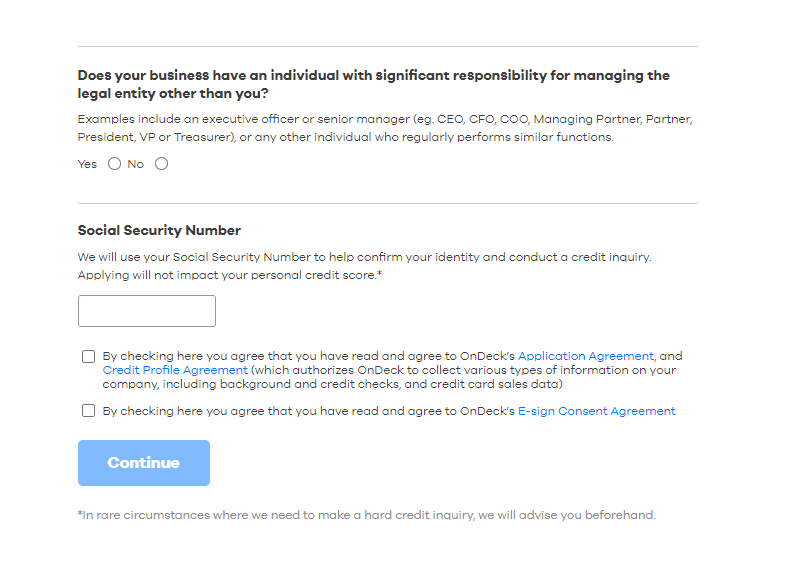

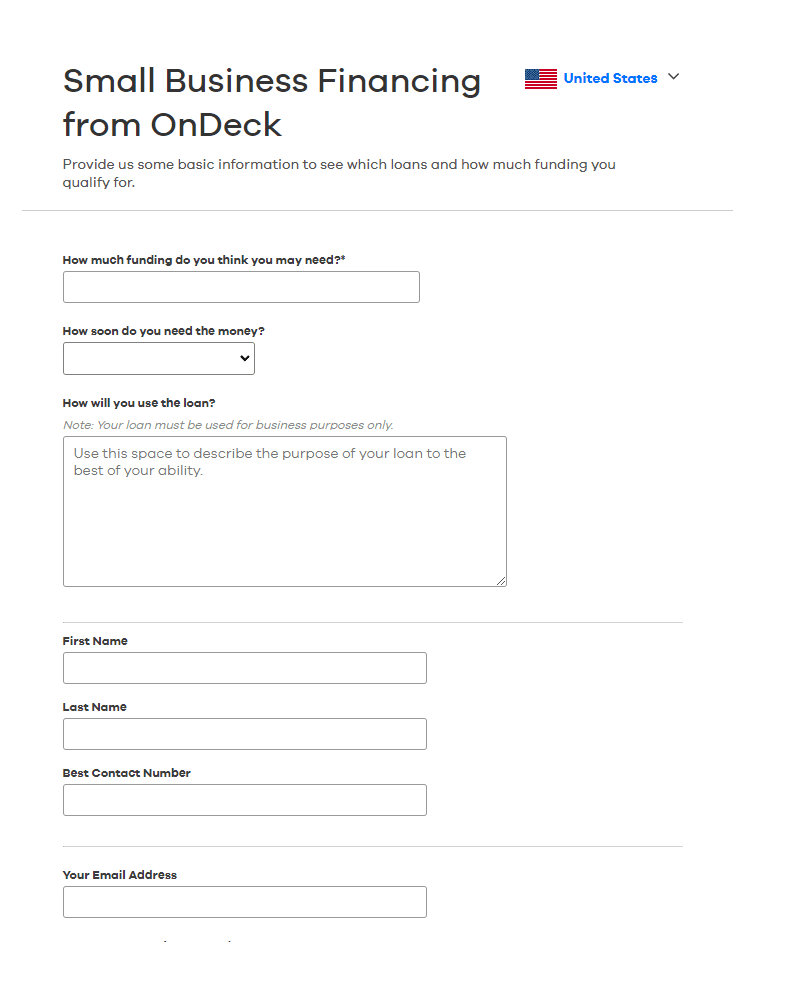

Let's look at some of the screens that you'll see when you go through the loan process.

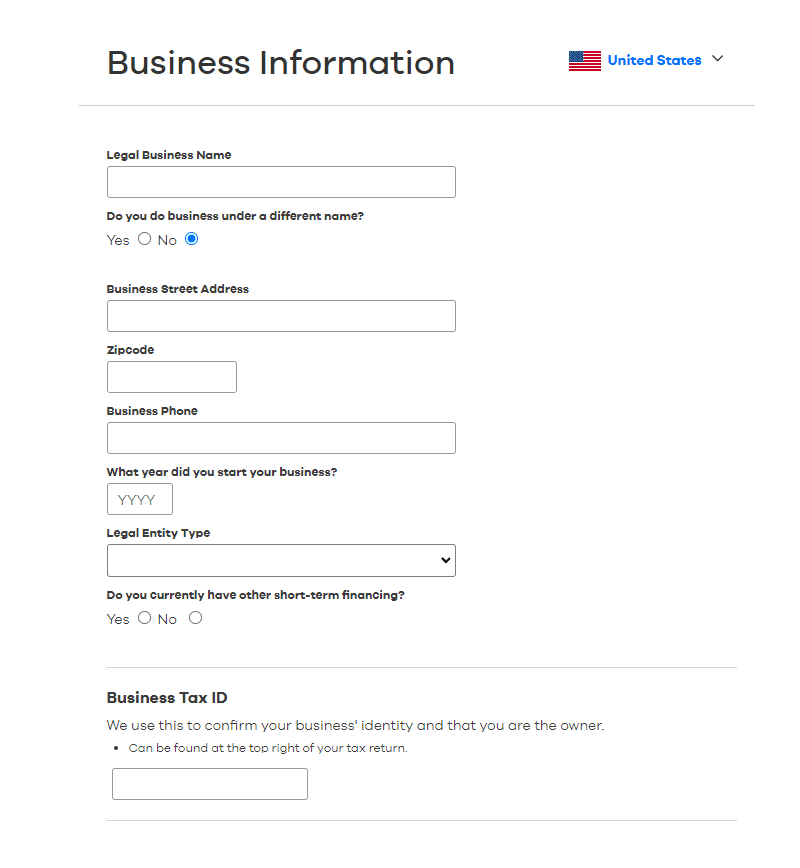

1. First, you’ll fill out personal information about you and your business entity.

2. Next, they’ll ask for your Social Security number and and other basic stuff.

3. Next, they’ll ask how much funding you think you’ll need, how soon you'll need it and what you're going to do with the loan. They want to make sure it's going to be for business purposes only.

As you can see from these screens, OnDeck makes it very easy to apply for a loan.

4. They're going to ask about your business, get your business tax ID, and your bank balance.

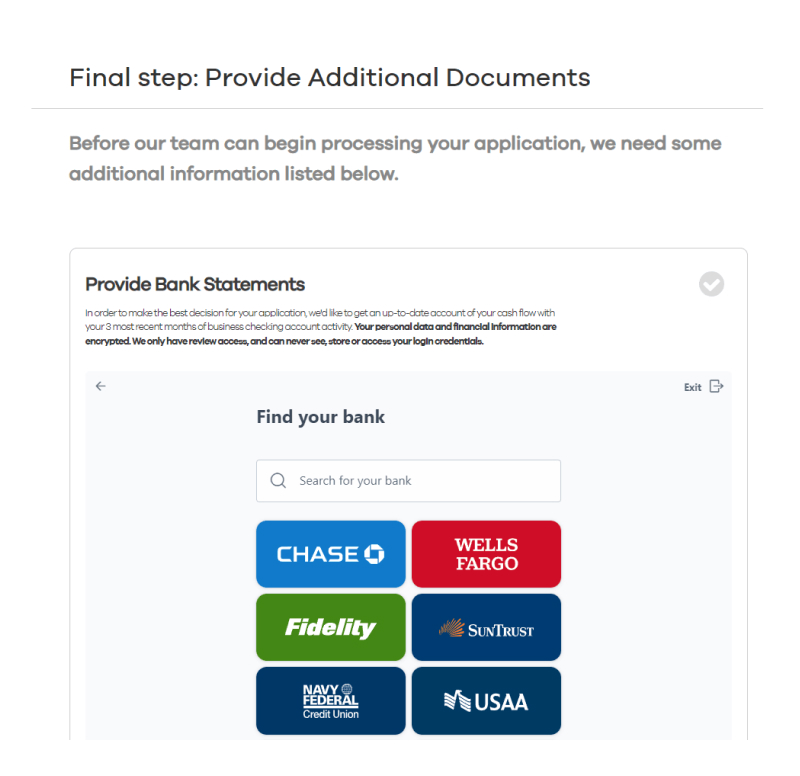

5. Then, they're going to ask you to provide bank statements and connect up your bank account.

You need to provide three months of your business checking account activity to get approved for a loan. By giving them your banking information, they can see your business statements for the last three months.

Connectiong your bank account, allows them to put money right into your bank electronically and automaticall when you get approved for the loan.

However, the other side of that coin is that when it comes time they're going to automatically take the payment out of your account to make sure that you're paying the loan according to the schedule you choose - daily, monthly or weekly.

That's part of the alternative lending game. You can't expect to work with alternative funding without recognizing that they're going to take the money according to their schedule electronically.

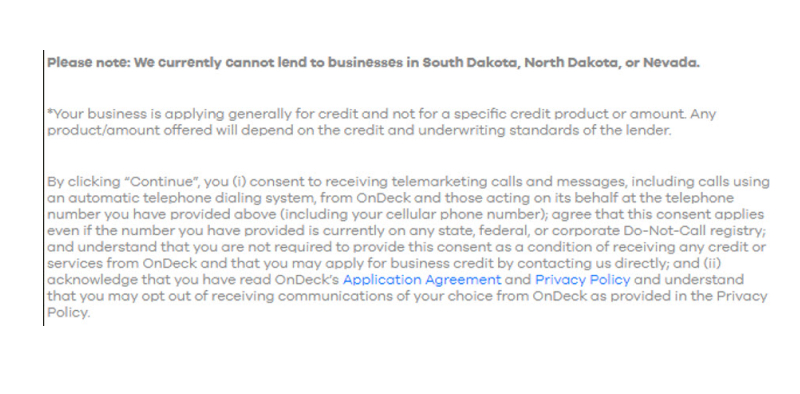

6. And finally, you’ll submit your application. Make sure to read the fine print, as you are consenting to receive calls from lenders offering loans to your small business.

OnDeck Customer Support

The contact center and live chat options are available between 9 AM and 8 PM ET Monday through Friday.

In rare instances, customers have reported it taking a little bit longer for the platform to respond to email queries, but this might not be a common occurrence.

Perks and Bonuses

Small businesses looking for a financial institution that is mindful about working with customers for the financial moment that they’re currently in may want to give Ondeck a second look. Ondeck currently has a small number of financial products for their customers. Borrowers can apply for lines of credit or term loans as needed.

Flexibility

OnDeck offers flexible repayment terms up to 24 months for term loans and 12 months for lines of credit. If, however, you are unable to make a payment, we recommend getting in touch with an OnDeck representative as soon as possible.

Transparency

OnDeck launched the SMART Box tool in 2016 to make financing more transparent for small business owners. “SMART” stands for Straightforward Metrics Around Rate and Total cost, and the tool makes it easy to understand rates and terms before you sign for a loan. For more specific questions, your OnDeck loan advisor is always available to assist.

Technology

The Ondeck website is easy to navigate and customers are able to find the products they’re interested in using. OnDeck users have access to an online portal and autopay option. Ondeck currently does not have an app paired with their service.

OnDeck Alternatives

Fundbox

Like OnDeck, Fundbox offers both short-term business loans and lines of credit. Loan amounts are a little less, ranging from $1,000 to $150,000. Rates start at 4.66% for lines of credit and 8.33% for term loans. Term loans are paid back over 24 or 52 weeks, and lines of credit are paid back over 12 or 24 weeks.

Qualifying for funding from Fundbox is a bit less stringent. A minimum credit score of 600 is needed, in addition to six months in business and $100,000 in annual revenue. OnDeck requires one year in business, so if your company is just getting started, a loan from Fundbox could meet your needs.

Read our complete Fundbox review for more information

Additional Alternatives

| Lender | Loan Amount | Interest Rates | Min. time in business | Min. Revenue |

| Bluevine | Up to $25K | Starting at 4.8% | 6 months | $10K per month |

| Credibly | Up to $400K | Starting at 6.99% | 2 years | $100K |

| Fora Financial | $5k to $750k | Varies | 6 months | $12,000 per month |

Final Thoughts

While interest rates and fees may be higher than with other lenders, the excellent customer service, ease of application, and quick funding process may make up for it. However, if you’re looking for cheaper rates or do not meet the minimum eligibility requirements, you may want to search elsewhere.