Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Small Business Loans For Minorities

Minority business owners sometimes find securing funding from traditional financial institutions challenging, mostly due to a limited credit history. Because of this, online lenders may be the best option when it comes to small business loans for minorities.

Nearly 20% of employer businesses are owned by minorities, yet gaining access to additional funding can often be a confusing process to work through.

Minority entrepreneurs may ask themselves the following questions: Which financial institutions should they work with? What are the lending criteria in order to be approved for the funding that they seek? Are the lending institutions that they are reaching out to going to offer a positive experience? And finally, what are the best small business loans currently available for minority-owned businesses?

Top Picks for The Best Small Business Loans For Minorities

- Lendzi - Best for Businesses with High Revenue

- Backd - Best for Cheapest Interest Rates

- SMB Compass - Best for Fast Funding

- Bluevine - Best for Lines of Credit

- Biz2Credit - Best for Working Capital Loans

- National Funding - Best For Equipment Loans

As an owner, you'll want to choose financial products and organizations that meet your current unique needs. Luckily, we’ve done the work for you and have found the best small business loans for minorities available today.

In this review, we highlight the rates, fees and terms of each lender and explain what makes them a good option. We also share potential downsides of each lender, and provide a rating methodology you can use to select the best option for your needs.

Best Online Business Loans for Minorities

Working with online lenders that offer unsecured business loans may offer more accessibility than with traditional banking partners. Online lenders may have unique loan products that serve very specific customer segments. Below are the top online business loans for minorities.

Lendzi - Best for Businesses with High Revenue

- Borrow up to $4 million in working capital

- Min. credit score: at least 500

- Min. time in business: 6 months

- Equipment financing up to $2 million

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Bad credit accepted

- Excellent customer satisfaction ratings

- Easy online application

- Applying will not impact credit score

- Fast funding times

- Startups may not qualify

- Income requirements may be high

Lendzi is both a direct lender and a lending marketplace, which gives minority business owners access to more than 75 lenders, each with their own loans and qualifications. Lendzi was founded in 2020 and so far has funded more than $500 million to small businesses. Not only that, but they also rank high for customer satisfaction. Currently, Lendzi has more than 2,000 5-star reviews on Google, TrustPilot, and Better Business Bureau.

Main Features

If your business has high revenue, we recommend a working capital loan or equipment financing from Lendzi. Working capital loans require a credit score of just 500 and allow you to borrow up to $400,000. Terms are between three and 15 months, and factor rates start at 1.15. With equipment financing, the equipment acts as collateral. This gives you a lower rate as opposed to other types of funding. The minimum credit score is 550, and rates start at just 3.49%.

To qualify, Lendzi recommends six months of business history and $180,000 or more in annual revenue.

Backd - Best for Cheapest Interest Rates

- Borrow up to $2 million

- Min. Credit Score: 640

- Min. Time in Business: 2 years

- Industry best factor rate for MCA - as low as 1.10

- APR for the Line of credit product starts at 35%

- Flexible repayment terms up to 16 months

- Get funding in as little as 24 hours

- Check your rate with a soft credit pull

- Tailored funding solutions to fit your needs

- Fast decision and funding times

- No collateral required

- Large loan amounts

- Flexible payment options

- Not all industries qualify

- Must be in business at least one year

- Rates are not disclosed prior to application

Backd was founded in 2018 with a mission to provide more access to funding to small businesses, including those owned by minorities. Since their inception, they’ve funded more than $1 billion to over 10,000 small businesses. They also understand that no two businesses are alike, and they’ve tailored their loans to fit your unique small business’ needs.

Main Features

Backd offers working capital loans and business lines of credit. Working capital loans range from $10,000 to $2 million with terms up to 16 months. Payments are flexible and are made daily, weekly, or semi-monthly depending on your business needs. Business lines of credit range from $10,000 to $750,000 with unlimited terms. To qualify, you need to be in business for at least one year and have $100,000 or more in annual revenue.

SMB Compass - Best for Fast Funding

- Loans up to $10 million

- Min. credit score: can go as low as 550 for certain loans

- Min. time in business: 1+ years in business, no startups

- Funding times: 5 to 7 days for term loans and 24 - 48 hours for line of credit

- Flexible terms: 2 – 10 years for term loans

- Interest Rates: starting at 8.99% for term loans

- Applying does not impact credit score

- Nine loan products to choose from

- Low, competitive rates

- Large loan amounts

- Loan terms up to 25 years

- Excellent customer service

- Poor credit not accepted

- Not available in all states

- Must be in business at least one year

- High revenue requirements

If you need a small business loan as a minority but aren’t sure which loan to choose, SMB Compass can help. They offer many loan products, including business lines of credit, business term loans, SBA loans, equipment financing, invoice factoring, and more. Customer service at SMB Compass is exceptional, and they are willing to help you choose the right loan for your minority-run business. To qualify, you’ll need a minimum credit score of 650, one year of business history, and $20,000 or more in monthly revenue.

Main Features

SMB Compass offers nine different types of small business loans to minority borrowers. Their mission is to make loans more accessible to small business borrowers by providing cost-effective and flexible lending solutions. SMB Compass business loans range from $10,000 to $10 million with terms up to 25 years. Rates start at 7.99% for qualified borrowers. The lender has currently provided more than 1,200 U.S. businesses with more than $250 million in financing. To apply, simply fill out their easy online application. It takes just a few minutes and will not impact your credit score. If approved, funding can be dispersed within 24 hours.

Bluevine - Best for Lines of Credit

- Funding up to $250,000

- Min. credit score: 625

- Min. time in business: 6 months

- Interest rates as low as 4.8%

- Loan Repayment 6-12 months terms

- Quick and simple application

- Rates as low as 4.8%

- Quick application process

- Excellent customer service

- Not available statewide

- Rates may be higher for lower credit scores

- Only B2B companies are eligible

Bluevine specializes in small business lines of credit as opposed to small business loans. A line of credit operates similarly to a credit card - you get approved up to a certain amount, draw on the funds you need, pay them back, and can use them again. Lines of credit are ideal for businesses who may need extra funding available for a longer period of time.

Main Features

Bluevine offers lines of credit from $5,000 to $250,000, with terms of six or 12 months from each draw. Rates start at 4.8%, and Bluevine does not charge any origination or prepayment fees. To qualify, you’ll need a minimum credit score of 625, a business history of at least six months, and $480,000 or more in annual revenue.

Biz2Credit - Best for Working Capital Loans

- Working capital up to $2 million

- Term loans up to $500,000

- Term loan interest rate starts at 7.99%

- Loan Repayment 12-36 months terms

- Variable APR depending on the applicant

- Funding in 72 hours

- Soft credit pull

- Minimum credit score of 575

- Multiple loan products available

- Fast approval and funding times

- Higher credit requirements for certain loans

- Not for start-ups less than six months old

Biz2Credit is best for smaller-sized minority businesses who may need additional working capital to help keep their business afloat. Biz2Credit currently offers three different loan products - working capital loans, term loans, and commercial real estate (CRE) loans - all of which have high limits for borrowers. Minority business owners may also be impressed with the 72-hour turnaround time from application to funding.

Main Features

Working capital loans are used to fund day-to-day operating expenses, including purchasing inventory, paying employees, paying for marketing expenses, and more. A working capital loan from Biz2Credit ranges from $25,000 to $2 million, with varying terms and repayment periods. To qualify for a working capital loan with Biz2Credit, you’ll need a minimum credit score of 575, a minimum annual revenue of $250,000, and to have been in business for at least six months.

National Funding - Best For Equipment Loans

- Min. Time in Business: 6 months

- Min. Credit Score 600

- Borrow up to $500,000 in working capital

- Equipment financing up to $150,000

- Factor rate From 1.10

- Fast funding

- Early payment discounts

- Equipment financing repayment 2-5 years

- Working capital repayment 4 months - 2 years

- Apply for an loan online from your home, office, or anywhere with internet connection.

- Great reputation on reputable sites like Better Business Bureau (BBB) and TrustPilot.

- No down payment required

- National Funding will charge you an origination fee of 1% to 2%

- High annual revenue is required

- Industries such as cannabis, adult entertainment, or guns won’t be able to get a loan because of certain regulations.

National Funding offers equipment loans to help your minority business buy new or used equipment that will allow you to operate successfully. You can get approved for up to $150,000, without a down payment and repay what you borrow every month.

Main Features

National Funding’s equipment loans cap out at $150,000 with repayment terms between two and five year years. The pay rate starts at 1.10 and you’ll repay your loan on a monthly basis. To be considered for an equipment loan, you’ll need a credit score of at least 600, at least two years of business history, and $250,000 or more in annual revenue.

Main Features of The Best Business Loans for Minorities

- Min. Credit Score - 550

- Min. Time in Business - 6 months

- Min. Annual Revenue - $180,000

- Loan Amount - Up to $400,000

- Interest Rate - Starting at 1.15

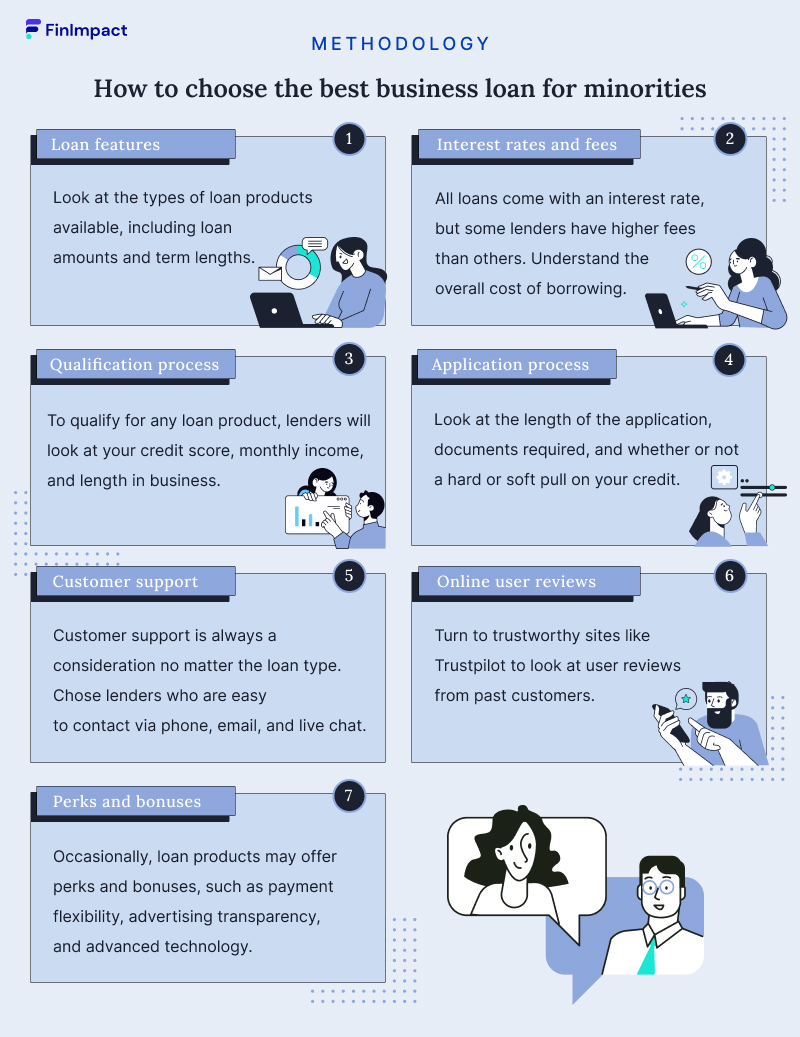

How We Choose the Best Business Loan for Minorities

We used the following criteria to choose the best lenders for minority entrepreneurs:

- Loan Features:We looked at the types of loan products available, including loan amounts and term lengths.

- Application process: The length of the application, documents required, and whether or not a hard or soft pull on your credit were all things we looked at when choosing lenders.

- Interest rates and fees: All loans come with an interest rate, but some lenders have higher fees than others.

- Qualification process: To qualify for any loan product, lenders will look at your credit score, monthly income, and length in business.

- Customer support: Customer support is always a consideration no matter the loan type. We chose lenders who are easy to contact via phone, email, and live chat.

- Online user reviews: We turned to trustworthy sites like Trustpilot to look at user reviews from past customers.

- Perks and Bonuses: Occasionally, loan products may offer perks and bonuses, such as payment flexibility, advertising transparency, and advanced technology.

U.S. Small Business Administration (SBA) Loans for Minorities

The SBA provides comprehensive and unique resources to help all small businesses succeed, and is focused on creating an ecosystem for the healthy development of minority-run businesses. Below are the following small business loans offered by the Small Business Administration:

- SBA 7(a) - This program has the goal of funding small businesses up to a maximum of $350,000. A unique feature is the speed in processing and approval of applications. Learn more about SBA 7(a) loans

- SBA Community Advantage Loans - Established in 2011, the SBA Community Advantage Loan program has the goal of increasing underserved communities’ access to credit. The maximum loan amount is $350,000.

- SBA Microloan Program - Lending intermediaries work with smaller businesses needing funding. The maximum loan via this program is $50,000. Borrowers are able to use the funds as needed, except for paying off debts or making real estate purchases. Learn more about SBA Microloans

- HubZone Contract Program - This program is focused on providing up to 3% of Federal Contracts to underserved communities.

It’s important to note that the SBA partners with lending organizations that work with minority-run businesses at the local level.

Nonprofit Loans and Other Lending Programs

Minority business owners aren’t limited to seeking funding from traditional financial institutions. There are numerous local, national, non-profit, and for-profit organizations that support unique communities. These partners may offer resources that traditional lenders cannot provide.

Union Bank’s Business Diversity Lending

Diversity Lending provides a variety of loan and banking products. Qualified customers can receive up to $2.5 million in funding. Union Bank also provides Minority Business Certification assistance through its certification center, a key component to proving a business is minority-owned.

Accion

Accion is focused on providing inclusive financial services and partnerships. Accion helps small businesses around the globe via equity investments, business advising, and partnerships.

Kiva

Those looking for a crowdfunding platform to fund their business should explore Kiva. The organization provides comprehensive support for micro-entrepreneurs. Kiva has a global audience but also provides services for U.S.-based entrepreneurs. For individuals looking to donate and lend funds to entrepreneurs, Kiva borrowers have a 96% repayment rate.

Business Consortium Fund (BCF)

BCF is part of the National Minority Supplier Development Council. The fund has microloans available that range from $10,000-$75,000 for qualified businesses. Loaned money can only be used in ways that are predetermined by BCF.

Indian Loan Guarantee and Insurance Program (ILGP)

ILGP program is available to enrolled members of tribes in the United States. In addition to being an enrolled member of a tribe, the company seeking funds must be at least 51% minority-owned. The company must also be focused on elevating and uplifting Native American Communities through its services.

Community Development Financial Institution Loans (CDFI)

CDFI fund partners with financial institutions across the United States. Currently, there are a little over 1,000 member institutions. These organizations make lending decisions unique to the communities that each partner serves.

Accompany Capital

Immigrant and refugee entrepreneurs face an uphill battle in establishing credit. Accompany Capital helps these groups gain access to credit via microloans, lines of credit, and small business loans.

U.S. Department of Agriculture (USDA) Business and Industry Loan

USDA Business and Industry loan program partners with various financial institutions who then distribute loan funds to applicants who meet predetermined criteria. Applicants’ projects should be based in a rural location. The Business and Industry Loan is not specifically targeted toward minority business owners.

Business Grants and Additional Resources for Minorities

In addition to online small business loans and nonprofit loans, grants are also available to minority business owners. Grant programs are a wonderful way to find funding for specific areas of one’s business, and best of all, small business grants do not need to be paid back.

SBA 8(a) Business Development Program - For entrepreneurs looking to gain access to government contracts, the SBA 8 (a) program helps qualified businesses work for the Federal Government through Sole Source Contracts. This allows businesses to avoid going through the bidding process in order to be granted a Federal contract.

SCORE - SCORE connects entrepreneurs with mentors that provide business-focused support. SCORE mentors can be found across the U.S.

Small-business grants - Grant funding can be an attractive way to pay for specific components of a business. Small business grants can be found via the SBA, your local municipality, or your state.

Minority Business Development Agency (MBDA) - Starting a business is difficult. Dealing with expansion and the growth of a business is even more challenging. MBDA works with entrepreneurs during the expansion and growth seasons of their businesses.

First Nations Development Institute Grant - Grants issued by the First Nations Development Institute are specifically focused on the economic betterment of Native American communities. With that in mind, businesses that are focused on this initiative are the most likely to win grants issued by this agency.

National Minority Business Council -This non-profit organization helps to connect minority businesses with adjacent professional support. The National Minority Business Council also seeks to create a community ecosystem that provides business additional resources to its members.

Which States Have The Most Minority-Owned Small Businesses?

According to MaxFilings, states with the most minority-owned small businesses include:

- California (1.6 million)

- Texas (1.1 million)

- Florida (926,000)

- New York (708,000)

- Gergia (371,000)

States with the least minority-owned businesses are

- Vermont (2,300)

- North Dakota (3,100)

- Wyoming (4,000)

- South Dakota (4,000)

- Maine (4,300)

The top five states with the highest percentage of minority-owned small businesses include

- Hawaii (57.6%)

- Texas (42.3%)

- District of Columbia (41.1%)

- California (41%)

- New Mexico (39.3%)

Who Qualifies for Minority Small Business Loans?

Minority-owned businesses are businesses where 51% or more of the firm is controlled by minorities, women, or veterans. In addition to meeting the minority-owned ownership threshold required by various government agencies, there are other requirements the borrower must meet. Businesses may be required to show their yearly revenue as determined by the lender. A minimum credit score and other details determined by the potential lender must also be met.

How Do You Apply for Business Loans for Minorities?

When applying for a loan with an online lender, you’ll fill out a preliminary application that takes just a few minutes. From there, you’ll be contacted by a representative from the company and asked for more details about your business. This may include a business plan, tax returns, income statements, and your business tax ID. You should get a lending decision within a few days, and funds are usually dispersed within hours to days of loan approval.

Conclusion

For minority-owned businesses, there are numerous ways to access the resources needed to grow a business. For those looking for loans, professional support, or grant programs, it’s likely that there is a program that will fit your business needs.

There has been a growth of financial institutions aiming to meet the needs of historically underserved communities. Finding the right loan products as a minority business starts with research and ends with personal preference.

*The required FICO score may be higher based on your relationship with American Express, credit history, and other factors.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!