Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Franchise Financing: Best Business Loan Options

Running a franchise involves handling staff, customer service, keeping track of cash flow, and operations, while paying franchise fees. This multitasking, especially for newcomers, can make it harder to profit. Securing the right financing to start and grow your franchise adds another complexity.

Lendzi - Best Chances for Getting Approved

- Borrow up to $4 million in working capital

- Min. credit score: at least 500

- Min. time in business: 6 months

- Equipment financing up to $2 million

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Easy, online application

- Fast funding times: Within 24 hours for some borrowers

- Bad credit accepted: Minimum score is 500

- Multiple loan options: Choose from seven different types of loan

- Competitive rates: Starting at 3.49%

- Rates can be high for those with poor credit

- High annual revenue requirement: $180,000

Lendzi was founded in 2020 with a goal of supporting businesses who struggle to get a loan. They are a direct lender and a lending marketplace, meaning the odds of getting approved are in your favor.

Main Features

Lendzi offers seven different types of financing for your franchise: short- and long-term business loans, business lines of credit, working capital loans, merchant cash advances, equipment financing, and SBA loans. Some cap out at $400,000, whereas others go up to $2 million. Rates are competitive and are mostly based on your credit score. The higher your score, the better the rate you’ll receive.

To qualify, you need to be in business at least six months and have $180,000 or more in annual revenue. One of the best features of Lendzi is their excellent customer service. A representative calls you once you apply to review your business and loan options with you. This allows you to ask any questions and not feel so alone in the process. Lendzi is definitely doing something right, as they currently have more than 2,000 5-star reviews on sites like Google, TrustPilot, and Better Business Bureau.

SMB Compass - Best for Variety of Franchise Funding Loans

- Loans up to $10 million

- Min. credit score: can go as low as 550 for certain loans

- Min. time in business: 1+ years in business, no startups

- Funding times: 5 to 7 days for term loans and 24 - 48 hours for line of credit

- Flexible terms: 2 – 10 years for term loans

- Interest Rates: starting at 8.99% for term loans

- Applying does not impact credit score

- Nine loan products to choose from

- Low, competitive rates

- Large loan amounts

- Loan terms up to 25 years

- Excellent customer service

- Poor credit not accepted

- Not available in all states

- Must be in business at least one year

- High revenue requirements

SMB Compass is an excellent choice for franchise owners with decent credit and high monthly revenues. The lender offers nine different types of products, including SBA loans, business lines of credit, asset-based loans, equipment financing, and more. If you qualify, you’ll be met with competitive rates, flexible terms, and excellent customer service. The lender expects credit scores of 650 or higher, monthly revenues of $20,000 or more, and at least one year of business history. If you need help choosing a loan product, a representative can walk you through the entire loan process.

Main Features

SMB Compass offers nine different types of small business franchise loans to borrowers. Their mission is to make loans more accessible to small business borrowers by providing cost-effective and flexible lending solutions. SMB Compass business loans range from $10,000 to $10 million with terms up to 25 years. Rates start at 7.99% for qualified borrowers. The lender has currently provided more than 1,200 U.S. businesses with more than $250 million in financing. To apply, simply fill out their easy online application. It takes just a few minutes and will not impact your credit score. If approved, funding can be dispersed within 24 hours.

National Funding - Best For Equipment Loans

- Min. Time in Business: 6 months

- Min. Credit Score 600

- Borrow up to $500,000 in working capital

- Equipment financing up to $150,000

- Factor rate From 1.10

- Fast funding

- Early payment discounts

- Equipment financing repayment 2-5 years

- Working capital repayment 4 months - 2 years

- Fast funding: Depending on when you apply, you may collect your funds via direct deposit within 24 hours.

- Solid reputation: National Funding has served business owners for over 20 years and funded over $4.5 billion for all types of businesses, including franchises.

- Excellent support: If you need assistance with your loan, you can reach out to National Funding via phone or email and speak to a dedicated loan officer once you’re approved.

- High annual revenue requirement: National Funding only lends to businesses who earn at least $250,000 per year so it can be a challenge to get approved if you’re just starting your franchise.

- Expensive rates and fees: Compared to loans from other lenders, National Funding equipment loans feature higher rates and fees.

- No mobile app: Unlike other lenders, National Funding doesn’t offer a mobile app you can use to keep tabs on your loan while you’re out and about.

National Funding offers equipment loans that go up to $150,000. Upon approval, you can use the funds to pay for the new or used equipment you need to run your franchise. Fortunately, there is no down payment required and you can prequalify without any impact to your credit score.

Main Features

National Funding’s equipment loans go up to $150,000 with repayment terms between two and five years. The pay rate starts at 1.10 and you’ll repay what you borrow every month. To be eligible for an equipment loan, you’ll need a credit score of at least 600, at least two years of business history, and $250,000 or more in annual revenue.

SmartBiz - Best for Creative Financing Solutions

- SBA 7(a) loans up to $350,000

- SBA commercial real estate loans up to $5 million.

- Min. Credit Score: 660

- Min. time in business: 2 years

- Loan Repayment 10 - 25 years

- SBA 7(a) loan rates: 10.75% - 11.75%

- SBA Commercial real estate loan rates: 5.50-6.75%

- Receive multiple loan offers

- 5-minute prequalification application

- Creative financing solutions

- Repayment terms up to 5 years

- Must be in business for 2+ years

- Strict applicant requirements

SmartBiz offers bank term loans and custom financing options for franchise owners ranging from $30,000 to $500,000. The bank term loans feature repayment terms of two to five years, which gives borrowers a longer-than-average time to repay the loan. The custom financing options include a business line of credit, invoice financing, and business credit cards. The line of credit allows franchise owners to pay back and draw down funding repeatedly. Invoice financing can be an appealing option, since it lets franchise owners sell outstanding invoices to a lender. The franchise then receives part of the invoice payments that the lender collects.

Main Features

Applying for financing with SmartBiz is easy, thanks to the five-minute prequalification process that can save applicants time. SmartBiz has strict applicant eligibility requirements, including having been in business for at least two years, having the cash flow to support loan payments, and having a credit score of 660 or higher.

Biz2Credit - Best for a Fast and Simple Application

- Working capital up to $2 million

- Term loans up to $500,000

- Term loan interest rate starts at 7.99%

- Loan Repayment 12-36 months terms

- Variable APR depending on the applicant

- Funding in 72 hours

- Soft credit pull

- Flexible terms: 12 to 36 months

- Funding up to $500,000

- Fast, simple application: Takes 4 minutes

- Get approved in 24 hours

- Funding 72 hours after applying

- High interest rates: Start at 7.99%

- Requires credit score of 660+

Biz2Credit offers term loans that franchise owners can use to build their businesses. Loan amounts range from $25,000 to $500,000. You can use the loan for your operational needs, including making equipment purchases or payroll. The loan can help to free up cash flow, and once funded, you’ll have access to the full cash amount upfront, which is ideal when you need the funding to make a large purchase.

Main Features

Most applicants have a credit score of at least 660, have been in business for at least 18 months, and have an annual revenue of more than $250,000. Applying for a term loan with Biz2Credit takes just four minutes, and you can get approved within 24 hours. You may have funding as soon as 72 hours after submitting your application. Interest rates start at 7.99%, and repayment terms range from 12 to 36 months.

Bluevine - Best for Low Interest Rates

- Funding up to $250,000

- Min. credit score: 625

- Min. time in business: 6 months

- Interest rates starting at 6.2%

- Loan Repayment 6-12 months terms

- Quick and simple application

- Replenishing credit line: For ongoing funding

- No opening, maintenance, or prepayment fees

- Up to $250,000 in funding

- Low 4.8% interest

- Fast approval: In as little as five minutes

- Must have $10,000+ per month in revenue

- Short terms: 6 or 12 months

BlueVine offers a business line of credit that franchise owners can repeatedly draw from. Credit lines are available up to $250,000, and as owners repay their line of credit, the credit line replenishes, creating a continuous funding line. With interest rates as low as 4.8%, this line of credit could be a good choice for franchise owners who are facing ongoing financing needs, such as during renovations, financing restaurant equipment (for example), or when navigating cash flow challenges. Franchise owners will only pay for the funding that they use, and the line of credit has no opening, maintenance, or prepayment fees.

Main Features

To qualify, applicants need to have a FICO score of at least 600. They also need to have been in business for at least six months, and should have at least $10,000 per month in revenue. The application requires basic business information, and you can be approved in just five minutes. Once approved, you can request funds through the online dashboard, and they can be deposited within hours. You can pay back each draw over a six- or 12-month term.

Fora Financial - Best for a Fast Approval

- Min. time in business: 6 months

- Min. credit score: 550+

- Borrow up to $1.4 million

- Factor rate from 1.15 to 1.40

- Ideal for plenty of industries

- Approval not solely credit based

- Early payoff discounts

- Flexible funding amounts: $5,000 to $750,000

- Multiple funding options

- Easy application: Just one page

- Application approval in 24 hours

- No collateral required

- Loan has short terms: Up to 15 months

- Must be in business at least 6 months

- Minimum credit score not disclosed

Fora Financial offers small business loans and merchant cash advances suitable for franchise financing. Small business loans are available in amounts from $5,000 to $750,000, making them a versatile financing option. There is no collateral required, and Fora Financial offers discounts for early payoff. The business cash advances are also available in amounts from $5,000 to $750,000, and they require no collateral. There is no restriction on the advance’s use, and no set terms.

Main Features

Small business loan or merchant cash advance applicants need to have been in business for at least six months. The small business loan requires that applicants have at least $12,000 in gross sales, while the merchant cash advance requires $5,000 in credit card sales. Both funding options have an easy, one-page application, and approval is made within 24 hours. Business loan terms are available up to 15 months, while the merchant cash advance is repaid based on your credit and debit card sales, giving you very flexible terms.

Credibly - Best for Low Credit Scores

- Min. Credit Score: 550+

- Min. Time in Business: 6 months

- Borrow up to Up to $250,000 in term loans

- Borrow up to $400,000 in working capital

- Term loan rates range between 8-25%

- Working capital factor rate starts at 1.09

- Simple application process

- As soon as same day funding

- Open to high-risk industries

- Multiple funding options

- Easy online application

- Variety of qualification criteria

- Cash advances are low-credit-score-friendly

- Limited information on interest rates

Credibly offers SBA loans, small business lines of credit, merchant cash advances, and equipment financing loans that franchises can use for their financing needs. The line of credit is available for amounts of up $250,000, while the merchant cash advance offers funding up to $400,000. The merchant cash advance may be particularly appealing to franchisee owners, since fluctuating revenue and low credit scores won’t necessarily prevent an applicant from getting funding.

Main Features

SBA loans have strict qualifying criteria and require that you have a 620+ personal credit score and have been in business for at least two years. Repayment terms range from two to five years. The line of credit minimum qualifying criteria include a personal credit score of at least 560, plus having been in business for at least six months and having at least $50,000 in annual revenue. Applying for a merchant cash advance is easier; you’ll need at least a credit score of 500, and you’ll need to have been in business for at least six months and have earned at least $15,000. Equipment financing doesn’t require a minimum credit score, and it’s easier to apply for because the new equipment serves as collateral. All Franchise Financing funding options feature online applications, and applications for merchant cash advances and small business lines of credit are reviewed within one business day. You can pre-qualify for equipment financing in just 10 minutes, and SBA loan applications are approved within 24 hours.

Main Features of Franchise Financing Options

- Min. Credit Score - 500

- Min. Time in Business - 6 months

- Min. Annual Revenue - $180,000

- Loan Amount - Up to $400,000

- Interest Rate - Factor rates starting at 1.15

In this review, we highlight the terms, rates and fees of each franchise financing company, and explain what makes it a good choice. We also share potential downsides of each company, and provide a rating methodology you can use to select the best equipment financing option for your needs.

Franchises can carry significant start-up costs, and owners may need to invest in a property purchase or lease. Even once the franchise is operating, paying for equipment purchases, expansion costs, and taxes can add up, especially when the business goes through periods of low cash flow. Many alternative small business lenders offer franchise financing to help you navigate these challenges. Our team of financial experts reviewed and ranked the top online lenders to help you get funded.

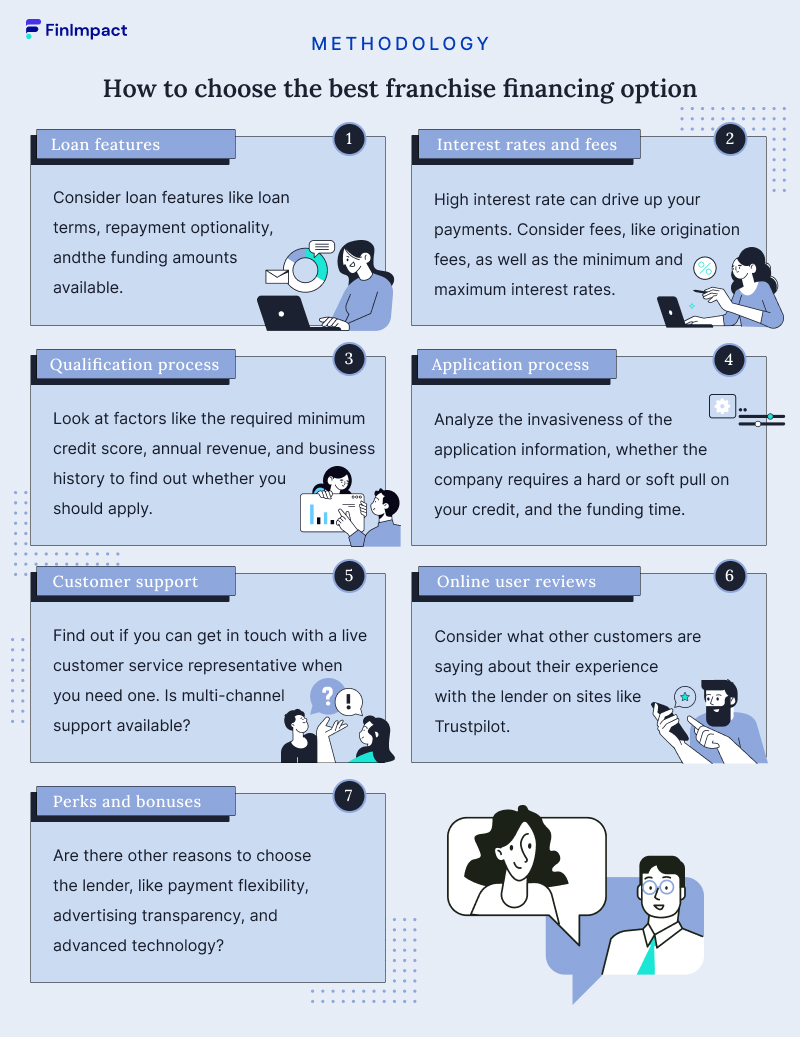

How to Choose the Best Franchise Financing Option

It’s important to choose franchise financing that’s right for you and your business. When evaluating funding options, it’s helpful to weigh several factors so you can understand the pros and cons of each option.

- Loan Features: Consider the specific features of the loan, including the terms, repayment optionality, and the funding amounts available. Make sure that you’ll be comfortable paying back the loan within the specified terms.

- Application process: How invasive are the application requirements, and how much time will you spend applying? Look into whether the application has a hard-pull or soft-pull credit score impact. If you’re in a hurry for franchise funding, consider how quickly applications are approved and loans are funded.

- Interest rates and fees: Consider different types of fees, like origination fees, as well as the minimum and maximum interest rates. A high interest rate can drive up your payments, and your franchise’s income needs to be able to support those higher payments.

- Qualification process: Will you qualify for funding? Factors like the required minimum credit score, annual revenue, and business history can help you to tell whether you should apply.

- Customer support: If you need help, can you get in touch with a live customer service representative? Is multi-channel support available, so you can get the help you need even when you’re also busy running your franchise?

- Online user reviews: Consider what other customers are saying about their experience with the lender on sites like Trustpilot.

- Perks and Bonuses: Are there other reasons to choose the lender, like perks like payment flexibility, advertising transparency, and advanced technology?

What is Franchise Financing?

A franchise is a joint venture between a franchisor and several franchisees. The franchisor is an original, successful business that sells the right to use its name, ideas, and products. The franchisees buy this right to trade under an existing business model.

Franchise financing is a term given to the process of securing a loan for getting your franchise business started. More prominent brands assist these individual stores with trade secrets, marketing, business plans, and other resources to help them succeed.

While franchises are an excellent way to ensure that you have a solid business plan in place, buying into these businesses can be expensive.

Insights Into The World of Loans for Franchises

Start-up costs for owning a franchise can vary from thousands to a few million dollars for some of the more popular franchises. While many franchises will require a franchisee to have a substantial net worth, one can purchase a franchise for $50,000 or less.

The franchisor will charge an initial franchise fee or license fee. Also, there will be a royalty payable based on the franchised outlet's financial performance. Besides this fee and costs, you may be restricted to selling only the stock or goods supplied by the franchisor.

How Much Does It Cost to Start a Franchise?

Buying into a franchise can be costly. The following are the costs that you should expect.

- Initial franchise fee: an initial fee is payable to the franchisor for the purchase of your business.

- Recurring franchise fees: these are often referred to as royalties, which are ongoing fees that you'll pay (usually monthly) to the franchisor as part of the original agreement.

- Marketing fees: the franchisor will most likely take care of the marketing for the brand as a whole.

- Required purchases: franchisors may require that you purchase certain goods or services for use within your store.

- Build out costs: Once you have secured your franchise outlet, you will have to pay initial rental plus a deposit, start renovating your premises, shopfitting, and so on.

- Hiring costs: there will be costs involved with the hiring and training of employees.

Things to Know Before Taking Out Franchise Financing Loan

Franchise loans are available for franchisees, but it's essential that you come armed with the following before approaching franchise financing lenders or a franchise financing company itself.

- Business and Personal Budgets: You will need to budget for the usual business expenses such as rental for the business premises, stock, salaries and wages, insurance, and other overheads. Then you must cover your salary and set an amount aside for unforeseen expenses. Set your goal for breaking even in the first year.

- Your Personal Net Worth: Net worth refers to how much capital you can access to invest in your franchise and tells franchisors and those in the franchise financing business how well you have managed your money historically.

- Financing Options: Do your best to know more or less what your financing needs and options will be. We will discuss these options in the next section.

- Time to Profitability: The franchisor and other franchisees in a chain should know how long it takes to become profitable. Speaking to them should give you a fair indication for inclusion in your forecasting.

- Developing Relationships: One of the biggest causes of franchise failure is because would-be franchisees go into a business with their eyes closed. We suggest that you develop as close a relationship as possible with the franchisor and the bank or lender that will finance you.

Where to Get a Loan for a Franchise?

The following are five different types of small business loans for a franchise.

1. Bank Loans

You will probably find that a successful franchisor's bank will be open to financing franchise opportunities based on its franchise client's track record.

Banks, however, tend to require more substantial documentation and will look at the prospective owner's credit rating and any other business credit ratings more closely.

A bank also tends to require self-contribution from a prospective franchisee and consider any available collateral.

2. SBA Loans

Another possibility is raising a loan guaranteed by the Small Business Administration (SBA). These loans typically offer attractive rates and terms. You should note that the SBA itself does not make loans, though.

Instead, it partners with a financial institution that makes the loan; then, the SBA undertakes to repay a significant portion thereof in the event of default.

3. Retirement Funds

Should you have a 401(k) or 403(b) retirement account, you might be able to borrow against it to fund a business—including a franchise.

There are many restrictions against using retirement funds for anything other than retirement, so be careful and seek a tax professional's guidance when considering this option.

4. Small Business Credit Card

Small business credit cards can be another road to take. They often provide high credit limits, which could make it possible to finance a low-cost franchise with a balance transfer—where the funds are deposited into your business bank account.

This carries its risks, of course, meaning that you could be looking at exorbitant interest rates on your outstanding balance. If handled properly, it could provide you with a good business credit rating further down the line.

5. Franchisor Financing

Two weeks before you purchase a franchise, the franchisor must provide you with a Franchise Disclosure Document (FDD). This document should contain any information about whether the franchisor offers to finance or may finance through one of its established lending partners.

Conclusion

Finding the right financing option can help franchise owners to successfully run their businesses. Financing options like short term business loans and lines of credit allow business owners to navigate challenging cash flow times, invest in business equipment, pay for renovations and expansions, and make other important investments in their business. As you explore these franchise financing options, be sure to consider factors like loan amounts, loan terms, interest rates, and eligibility requirements to determine which option is best for your business.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!